Included in the vn30 index, PDR embraces national and international funds’ investment

1st February 2021 witnessed PDR officially entering the VN30 Index on the Ho Chi Minh City Stock Exchange. This index represents 80% of HOSE’s market capitalization and 60% of total trade value on the Vietnamese stock market. To be added to the basket, PDR has satisfied all the quantitative requirements (regarding market cap, liquidity, free-float percentage, etc.) and qualitative ones (regarding brand prestige, transparency, good relationship with shareholders, customers, partner, etc.). This also builds up a premise for investors, especially domestic & foreign financial institutions and funds, to increase their PDR ownership in the future.

PDR passed all stringent criteria to enter the VN30-Index

Based on the new HOSE-Index rule version 3.0 issued at the end of 2020, the Ho Chi Minh City Stock Exchange employed new criteria to select constituent stocks added to the VN30-Index. Notably, the changes include conditions on Free float screening, adjusted market cap, the average matched volume (over 100,000 shares/session), and the average trading value (over VND 9 billion/session).

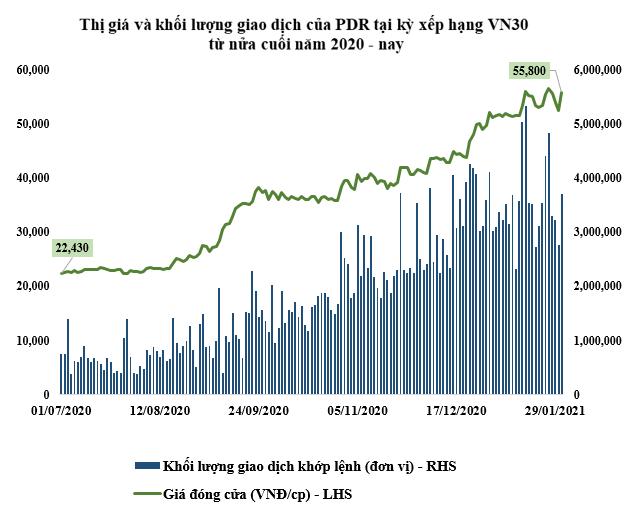

As of 31st December 2020, PDR’s average market cap in the second half of 2020 (from 1st July to 31st December) stood at VND 14,700 billion, ranked 31st on the market; the average trading value reached 67.6 billion/session; the number of outstanding shares for the index calculation was 396,169,897 units; and the free-float percentage was rounded to 40% with the capitalization limit of 100%.

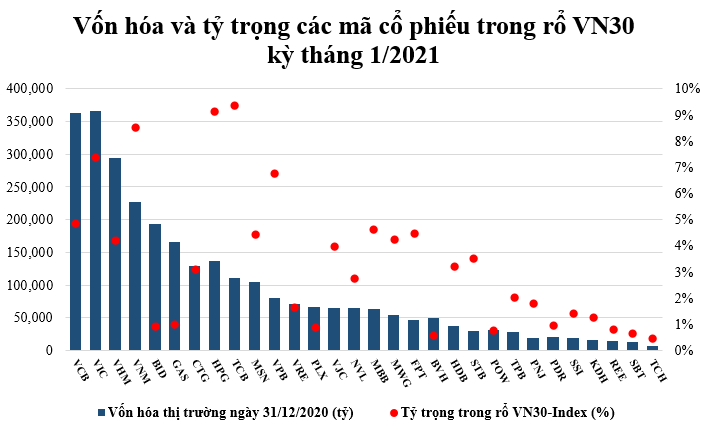

In the VN30-Index, PDR is ranked 25th by market capitalization (reaching ~ VND 20,400 billion at the end of 2020 and ~ VND 21,591 billion at present) and ranked 23rd in terms of portfolio’s proportion at ~ 1.0%. Also, in the January 2021 Review, PDR, BVH, and TPB were added to the VN30-index, while ROS, SAB, and EIB were excluded.

Establishing a premise for investors, especially domestic and foreign financial institutions and funds, to increase ownership in PDR

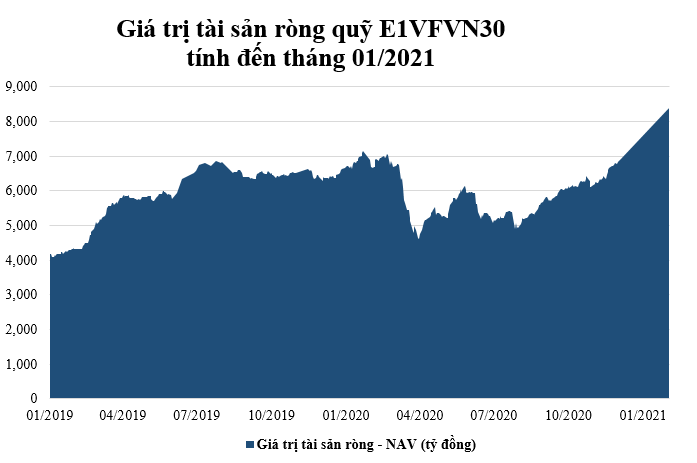

For the Vietnamese market, passive investment funds like VFMVN30 ETF, SSIAM VN30 ETF, and MAMF VN30 ETF, with a total asset under management reaching approx. VND 9,066.9 billion, are closely tracking VN30-Index. As such, with the 1.0% proportion in the VN30-Index, they are expected to buy about 1.8 million shares of PDR with a value at about VND 90 billion.

Recently, investors, especially foreign investors, increasingly prefer ETFs thanks to their advantages of superior effectiveness (compared to the market), the simple and fairly convenient trading, low cost, and the management of professional funds. There is much room for these ETFs to develop, for the total size of current ETFs is under USD 2 billion, accounting for ~ 1% of the nearly USD 200 billion market capitalization.

From the beginning of 2021 to 22nd January, VFM, and MAFM – the two funds tracking VN30, have increased their investment capital to USD 27.63 million & USD 3.37 million accordingly, representing 42.6% of the increased investment value of 13 ETFs holding Vietnamese stocks.

Alongside domestic ETFs, foreign ETFs like FTSE Vietnam ETF, VNM ETF, Premia MSCI Vietnam ETF, iShare MSCI Frontier 100 ETF, S&P Select Frontier ETF, etc. are considering or increasing their ownership in PDR following the strategy of proportionally allocating investment in Vietnamese blue-chip stocks. Besides, active investment funds which can select regional or sector stocks by growth and corporate sustainability criteria have more interest and confidence in VN30’s constituent stocks due to the reduction in preliminary analysis works.

PDR as a good choice of growth potentials to investors

In 2020, PDR established strategic partnerships with Danh Khoi Holdings (DKRH) – Netland Investment, Central, Rita Vo, Kohler, Aka Furniture, and Turner to implement Astral City – a commercial & apartment complex in Binh Duong Province, with an estimated investment of VND 8,282 billion. In 2019, PDR successfully joined the cooperation with Samty Asia Investments Pre.Ltd (a subsidiary of Samty Corporation – a Japanese leading real estate corporation) with an investment of USD 22.5 million to support projects in HCMC.

Most recently, prestigious international organizations included PDR in their lists and ratings, such as the MSCI Frontier Market 100 Index, Forbes Asia’s top 200 Best Under A Billion list in the Asia-Pacific region, etc.

(Source: HOSE)

Currently, in the VN30-Index, the number of real estate stocks modestly stands at 4 (VHM, NVL, KDH, and PDR), accounting for about 11.3% of the total value. Adding PDR to the VN30-Index accurately reflects the increasing impacts of the real estate group rather than the banking sector’s domination as before. Additionally, this adding has demonstrated PDR’s prestige, brand value, and influences on the market; the continuous increase of market capitalization and liquidity affirms the right strategy that PDR is following.

Given that the foreign ownership limits up to 49%, PDR entering the VN30 index opens up new opportunities and possibilities for further cooperation between PDR and foreign investors in terms of both strategic investment and financial investment in the future.