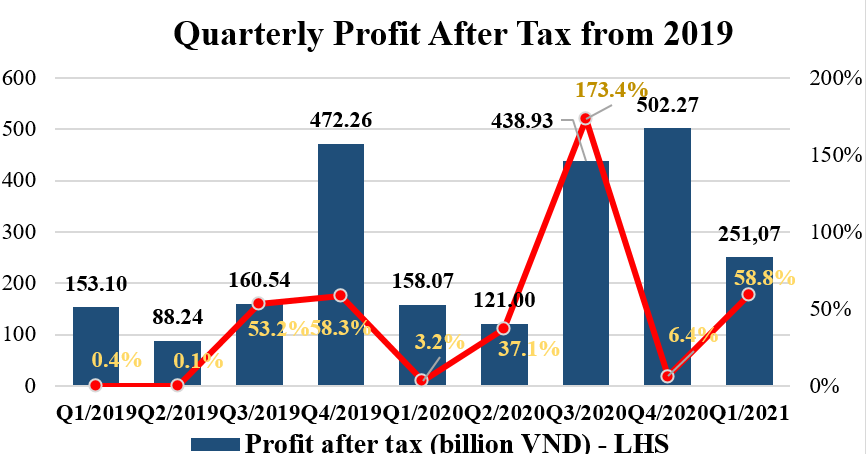

Phat Dat makes a leap jump in 1Q2021’s profit, up 60% compared to that of 1Q2020

Phat Dat Real Estate Development Corporation announced the business result of 1Q2021, including the profit after tax (PAT) increasing by 60% YoY and the market capitalization surging strongly at over USD 1.5 billion.

According to the quarterly consolidated financial statements of Phat Dat, 1Q2021’s net revenue reached VND 586.1 billion, and the profit increased sharply by 60% YoY. Profit before tax (PBT) and PAT reached VND 314.93 billion and VND 251.07 billion, respectively. Hence, although the market economy is greatly affected by the epidemic and many businesses have to narrow down or stop their business, the Company continues its presence in the top 15 real estate enterprises by profit in 1Q2021.

Such an impressive increase in profit comes from the accelerated implementation of infrastructure and the partial handover of land lot products of Zone 9 inside Nhon Hoi Ecotourism Area, Binh Dinh province.

Gross profit margin in the first quarter of 2021 also increased to 65.7% (compared to that of 1Q2020 at 39.6%), equivalent to the gross profit at VND 384.97 billion (up 54.4% YoY).

Quarterly PAT and growth rate of PDR (Source: Consolidated Financial Statements – PDR)

Selling expenses dropped sharply by 84.9% YoY to VND 4.2 billion because of no incurring brokerage costs during the period. General and administrative expenses increased by 84.2% YoY, reaching VND 43.1 billion, mainly from the 62.9% increase in salary expenses at VND 22.6 billion resulting from the growing personnel and operational scale. The cost of external services expenses increased by 3.7 times, reaching VND 15.3 billion. Net profit from business activities in1Q2021 reached VND 316.6 billion (up 59.6% YoY).

By the end of the quarter, PDR also recorded a negative 1.7 billion VND in other income, while last year was negative 0.4 billion VND. Total accounting PBT reached VND 314.9 billion (up 59.1% YoY), and the net profit reached VND 251.1 billion (up 58.8%). EPS reached 558VND/share (up 16.5% YoY).

In the balance sheet, as of 31st March 2021, PDR’s total assets increased by 11.2% compared to the end of 2020, reaching VND 17,363.4 billion. In which, cash and cash equivalent decreased from VND 53.2 billion to about VND 7.8 billion. The short-term financial investment was at VND 12.2 billion – the same level as at the end of 2020.

Short-term receivables increased by 67.4% YTD to VND 2,537.3 billion, mainly due to the other short-term receivables increased by 4.5 times YoY to VND 1,234.2 billion. Short-term advances to suppliers and provision for doubtful short-term receivables remained unchanged compared to the end of 2020.

Inventories increased by VND 1,301.1 billion in the first 3 months of 2021, reaching VND 10,632.1 billion (up 13.9% YTD), including a rise of VND 1,371.5 billion of the new project of Phuoc Hai and a drop of VND 80.9 billion deducing from the revenue recognition of Zone 9 in Nhon Hoi Ecotourism Area to VND 1,392.7 billion.

Regarding the long-term assets, long-term receivables remained at VND 989.4 billion while fixed assets increased by 6.1% to VND 36.2 billion; investment properties slightly dropped to VND 69.0 billion. Long-term asset in progress increased slightly by 2.5% to VND 920.7 billion due to the ongoing projects of the office building at 39 Pham Ngoc Thach (District 3) and internal infrastructure construction of Zone I – Co Dai Area (District 9, HCMC)

(Source: Consolidated financial statements – PDR)

As of 31st March 2021, total liabilities reached VND 10,495.8 billion, relatively unchanged from the beginning of the year. In breakdown, the amount of VND 5,547.43 billion was recorded as the long-term payables from the two transferred projects, The EverRich 2 and The EverRich 3, equivalent to 52.9% of the total payable balance. The amount, in fact, is not a debt of PDR because PDR transferred the two projects to partners and received the corresponding amount in 2019. Upon completing legal procedures, the amount will be recorded in the revenue section.

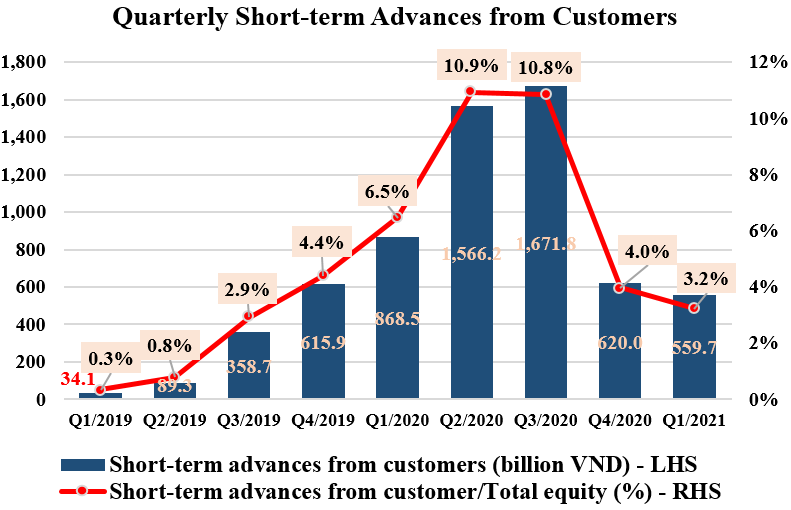

Besides, short-term trade payables decreased slightly by 2.5% to VND 281.0 billion. Short-term advances from customers dropped by 9.7% to VND 559.7 billion due to the customer’s prepayment of the Nhon Hoi Ecotourism City project. Also, an amount of VND 407.25 billion, recorded in the Statutory obligations account, is due in April 2021 and expected to be paid on time.

Short-term loans fell by 7.8% YTD to VND 1,303.7 billion. In detail, loans from banks decreased by VND 101.2 billion, issued bonds decreased by VND 53.5 billion, and loans from other parties increased by VND 44.8 billion.

Long-term loans increased by VND 389.7 billion (up 80.3% YTD), standing at VND 874.9 billion mainly due to an increase of VND 396.7 billion in long-term bonds standing at VND 643.9 billion. This results from the 2-year-term bond issuance on 2nd February 2021 with a total value of VND 400 billion and an interest rate of 13% per year. The issuance is to fund Zone 2 & Zone 9 inside Nhon Hoi Ecotourism City (Binh Dinh Province) and subsidiaries to develop Binh Duong Tower Commercial & Apartment Complex and the internal technical infrastructure of Zone I (Co Dai Area Zone) in HCMC.

Also, PDR has built a roadmap for restructuring loans toward the end of May 2021. Accordingly, the total balance of short and long-term loans is estimated to be at VND 1,475.0 billion, accounting for 27.7% of the total equity of VND 5,323.5 billion.

The Company targets VND 2,335 billion in 2021’s pre-tax profit and VND 14,270 billion in accumulated pre-tax profit of 2019-2023 (the residential real estate segment alone), corresponding to a CAGR at 51% per year.

Also, Phat Dat aims to transform itself into a professional conglomerate with a diverse business portfolio, rooting from the core competency of project development. Besides the key sector of residential real estate, Phat Dat expands its business into industrial real estate and renewable energy sectors. This demonstrates flexibility in project strategy to diversify revenue sources, generating sustainable cash flow and a stable financial foundation.