What is the current debt situation of Vietnam's real estate industry?

Following the Evergrande incident on 20th September, recent market movements have witnessed huge interest in the financial health of Vietnamese real estate enterprises. Here are some of the noticeable “big guys” in the industry.

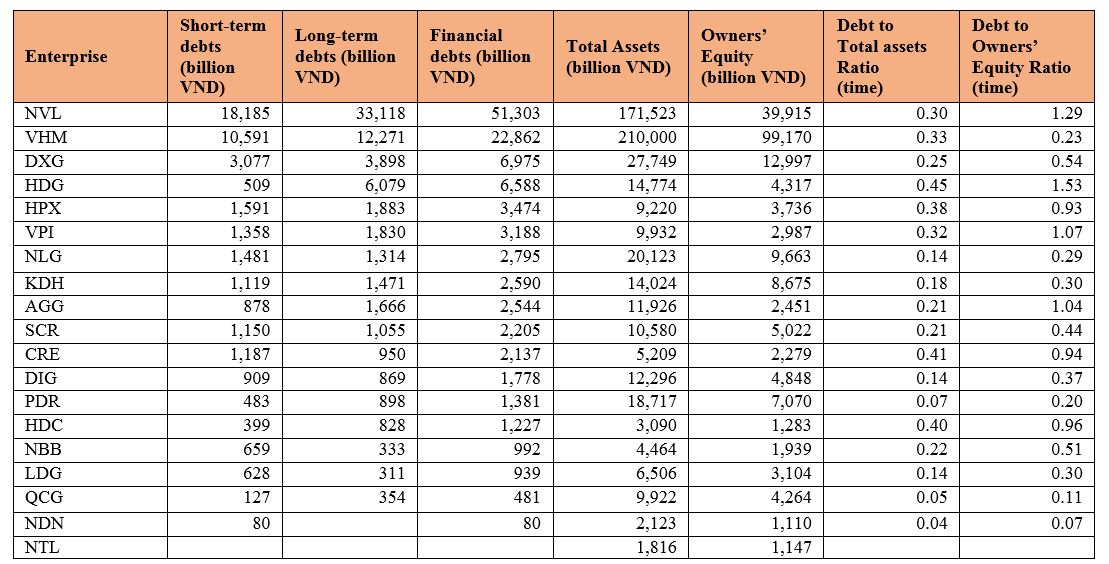

Statistically, as of 30th June 2021, 19 residential real estate enterprises had a total debt of VND 113,460 billion, a 5% increase from the beginning of the year. Most of the debt ratios from these businesses range within an acceptable level, and the average debt-to-equity ratio is only 0.52.

Source: NDH

By the end of 2Q2021, Phat Dat Real Estate Development Corporation (HOSE: PDR) had short-term debt at only VND 483 billion (down 66%) after settling VND 930 billion from bank loans, bonds, and borrowing from other parties. Thus, PDR is the real estate enterprise with the lowest debt level in the VN30. According to the Company’s financial statements and information collected by Mirae Asset Securities, PDR’s total short-term and long-term debts were at VND 1,381 billion by the end of 2Q2021. Owing to the recent growing revenue and a low D/E ratio with no signs of “increasing” debts shortly, PDR is expected to record VND 5,147 billion in revenue and VND 2,061 billion in profit after tax in 2021, up 31.6% Y-o-Y and 68.9% Y-o-Y, respectively. The Company also stated that by implementing a strategy shifting from short-term to long-term debt with preferential interest rates, it would achieve high efficiency in future investment activities.

Debt and Debt-to-Equity Ratios

Source: Enterprises’ financial statements, calculated by Mirae Asset Vietnam Research

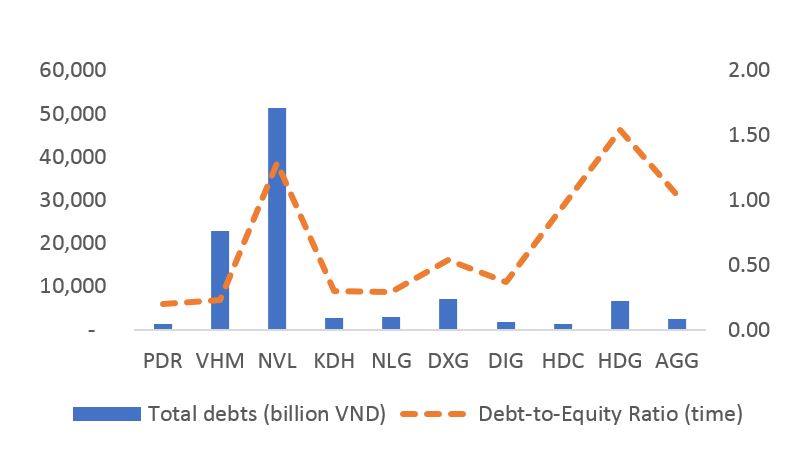

Assessing Z-score

Among top listed real estate enterprises, PDR has a Z-score of 2.79 – a considerably ideal level.

Z-scores of real estate enterprises

Source: Enterprises’ financial statements, calculated by Mirae Asset Vietnam Research

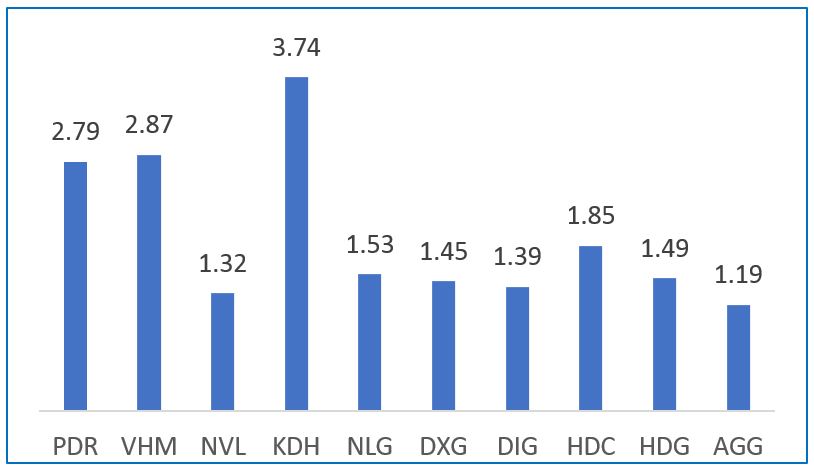

Assessing ROE and ROA

ROEs and ROAs

Source: Mirae Asset Vietnam Research’s forecast and compilation

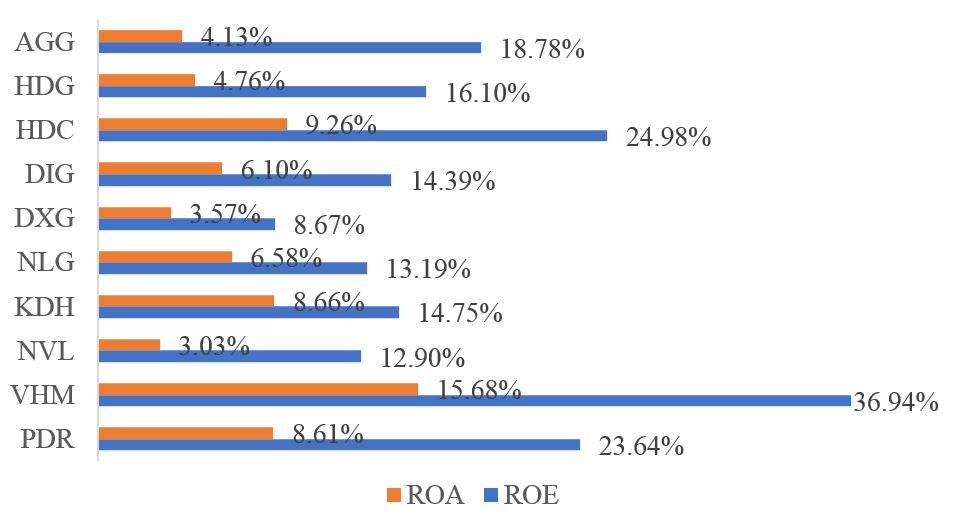

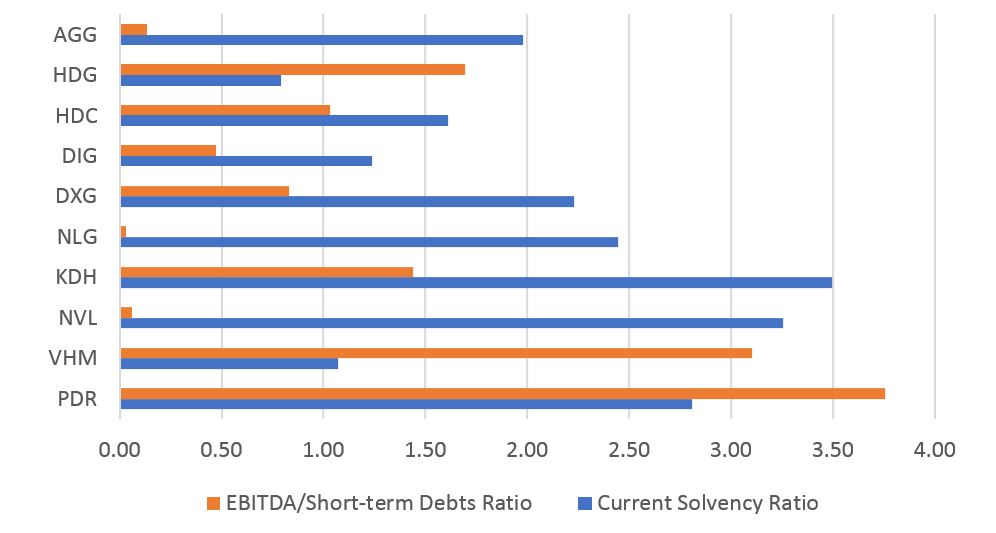

According to the Company, positive cash flow from operating activities has been steadily increasing in recent years, exceeding VND 4,300 billion in 2020. Also, PDR’s cash reserves declined sharply in 2020 as the result of land acquisitions worth VND-3,800 billion. Thanks to consistent and positive cash flows, PDR has the best payout ratio among real estate enterprises on HoSE. Additionally, the current solvency ratio is 2.8 times (compared to the industry average of only 2.1 times), and the EBITDA/Short-term Debts ratio is 3.7 times (the highest in the group and 3 times higher than the industry average).

Solvency ratios of real estate enterprises

Source: Enterprises’ financial statements, calculated by Mirae Asset Vietnam Research

When looking at the current financial indicators of Vietnam’s real estate enterprises, it is evident that these indicators are still at a low level; however, Evergrande’s debt ratio and liabilities have crossed the “red line,” and the debt dues are pretty high. The debt ratios of Vietnamese residential real estate enterprises are generally acceptable. According to the initial assessment of Maybank Kim Eng Securities (MBKE), it is inappropriate to compare Evergrande’s incident to some Vietnamese enterprises with similar business lines. The report points out that one of the most noticeable differences (and the most serious problem of Evergrande) is that Evergrande’s debt ratio is at a very high level, much higher than that of all Vietnam’s real estate businesses.

A recent VNDIRECT report shows that there are 3 factors driving residential real estate demand in the second half of 2021 and 2022. Firstly, a large-scale market recovery will help boost the real estate industry in the second half of 2021 and 2022. The world economy will soon be reopened in the second half of 2021 as a result of the rapid vaccination deployment. Second, mortgage interest rates remain low, which stimulates housing demand. Domestic banks’ mortgage interest rates remained relatively stable in 1H2021, at 9.2 – 9.5 percent – the lowest in 10 years. Third, promoted infrastructure development will be the primary driver of future real estate market growth. With stable financial indicators and positive market potentials, the Evergrande incident is considered unlikely to happen in Vietnam and will have no impact on the domestic real estate market, which is steadily growing.