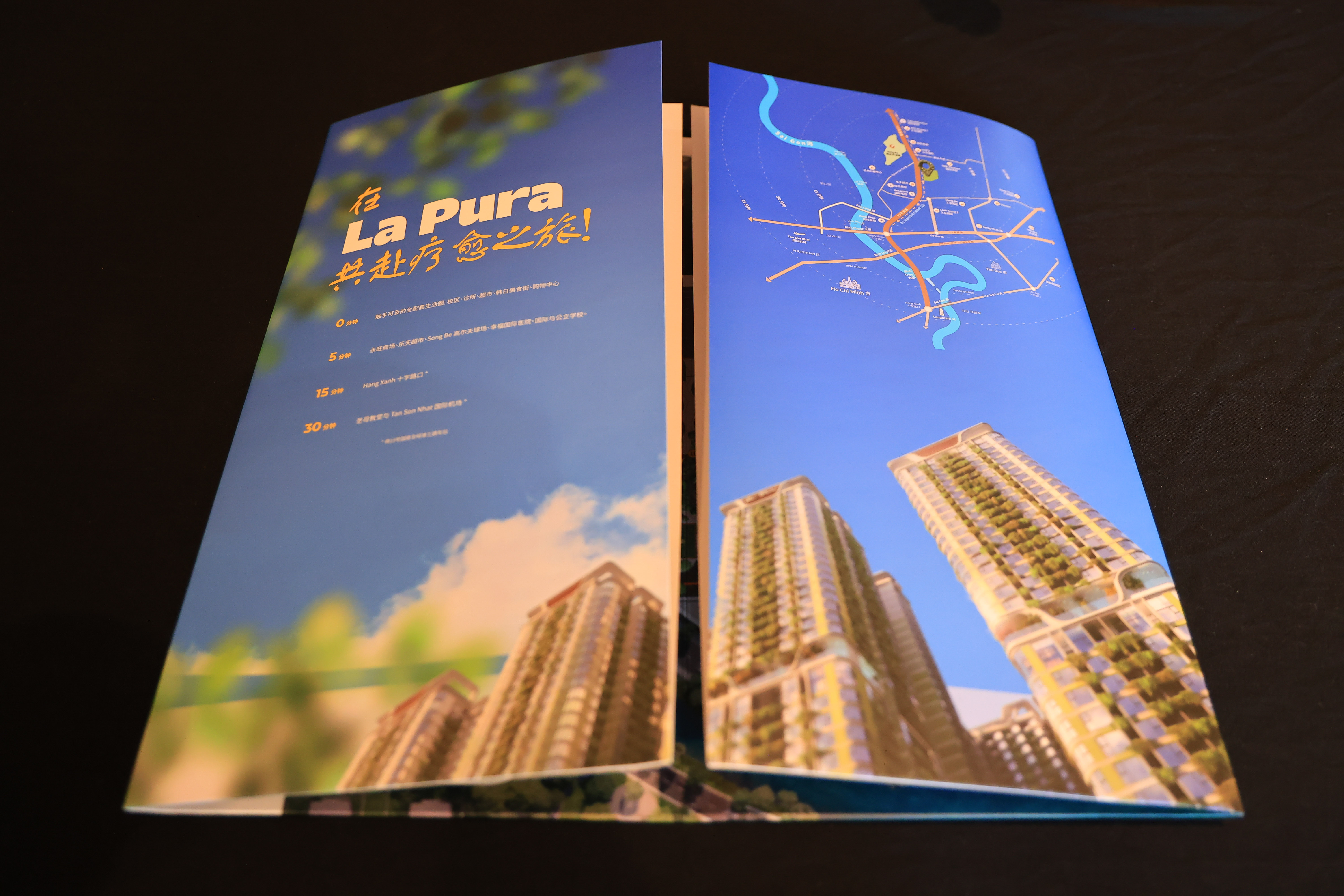

La Pura: From HCMC to Shanghai – Bringing the healing city concept to the global stage

Phat Dat Development Corporation (PDR: HOSE), in collaboration with its sales agent Indochine, has officially introduced the La Pura Healing City to the international investor community at JW Marriott Shanghai, the financial hub of Shanghai (China), on December 6.

The event marked a strategic milestone for Phat Dat in its efforts to bring Vietnamese urban development standards to the global stage. At the same time, it generated strong momentum in attracting high-quality capital, reaffirming the sustainable profit potential of the Northeast core growth corridor—an area entering one of the most dynamic growth phases of the Ho Chi Minh City metropolitan region.

In practice, the event drew hundreds of international investors, the majority of whom had prior experience in Vietnam’s real estate market.

International investors also emphasized that La Pura is not a first-time investment, but rather the next destination in a proven series of successful investment journeys in Vietnam, supported by three key factors.

First, at the macro level, Vietnam’s real estate market today is replicating the “golden cycle” that China experienced in the early 2000s.

According to Savills’ Q3/2025 Vietnam real estate market report, Vietnam’s GDP grew between 7.5% and 8%, leading the region. At its 10th session, the National Assembly also passed a Resolution on the 2026 socio-economic development plan, setting targets for double-digit GDP growth of 10% or more, with GDP per capita reaching USD 5,400–5,500.

In parallel, from a market cycle perspective, Vietnam is currently at the early stage of a value appreciation cycle, which typically lasts from two to five years.

Experts analyze that rising real estate demand usually accompanies economic growth. As GDP increases, average and household incomes rise accordingly, inevitably leading to higher housing demand—particularly driven by migration to major cities. Moreover, GDP growth targets generate an urban spillover effect, accelerating public infrastructure development and urbanization, which in turn creates strong demand for offices, housing, and retail spaces.

Second, growth momentum driven by the planning and integration of the Ho Chi Minh City mega-urban area, with TOD cities set to benefit.

Alongside the national push for double-digit GDP growth, HCMC – the country’s economic engine, has also accelerated on multiple fronts. Notable developments include a series of billion-dollar infrastructure projects: key ring roads being rapidly implemented, completed, and put into operation (Ring Road 3 scheduled for completion in 2026; Ring Road 2 to break ground in late 2025; Ring Road 4 to commence construction in 2026); prioritized investment in nine Metro lines over the next 5–10 years (six lines in the central area, two lines in the former Binh Duong, and one line serving Vung Tau); railway projects proposed by Vinspeed and Thaco expected to be completed within five years; and 198 key infrastructure projects inaugurated or commenced on December 19, 2025, among others.

In reality, wherever infrastructure advances, real estate accelerates. Over the past decade, Vietnam’s real estate market has been regarded as an investment success beyond expectations for most international investors, with asset values increasing by an average of 200%–300% (rental yields of 5%–7.5% per annum). These projects share common characteristics: frontage on major roads, Metro lines at their doorstep, and all-in-one urban planning.

International investors attending the Shanghai introduction event assessed that La Pura has emerged at precisely the right time, as HCMC enters its “golden cycle.” With a stable economic growth trajectory, a young population, and an expanding consumer market, real estate in TOD-driven growth cities is expected to appreciate strongly. This has already been proven through their prior investment experiences in areas such as Thao Dien along Hanoi Highway—now served by Metro Line No. 1—or along Mai Chi Tho Boulevard (former District 2).

“We believe that La Pura, with its advantages of frontage on National Highway 13, an all-in-one urban development model, and especially a Metro station right at the doorstep, will experience strong value appreciation in long term,” emphasized an investor at the event.

Previously, La Pura was also honored as one of the Top 5 most promising TOD urban projects in the Southern Key Economic Region, affirming its well-structured planning and outstanding growth potential.

Third, attractive pricing and policies tailored for foreign investors.

If favorable macroeconomic conditions and TOD mechanisms are the necessary conditions, then competitive pricing and suitable policies are the sufficient conditions driving international investors’ decisions to invest in La Pura.

Reviewing Vietnam’s real estate market over the past decade since July 1, 2015 – when the new Housing Law officially took effect – foreign ownership has been regulated to no more than 30% of total apartments in a project; a maximum of 250 low-rise houses per ward; with ownership terms of 50 years, extendable by another 50 years upon expiry. Statistics from 2015 to 2024 show that tens of thousands of real estate products have been sold to foreign buyers, particularly from South Korea, Japan, China, Taiwan, Hong Kong, Singapore, and others.

Accordingly, based on approvals issued by the Binh Duong Provincial People’s Committee (formerly, now part of HCMC) – Department of Construction under documents No. 4695/SXD-QLN and 4696/SXD-QLN, La Pura is permitted to sell apartments to organizations, individuals, and foreign buyers, with the total number not exceeding 30% of the project’s total units.

In addition to legality, La Pura is highly attractive with initial equity capital starting from only VND 290 million, flexible payment schedules, and optimized financial support packages. This is considered an entry-level price in the pre-operation phase of TOD infrastructure, significantly lower than prices in cities such as Bangkok, Seoul, or Shanghai – and mirrors the strategy that this group of international investors successfully applied in Thao Dien nearly a decade ago.

Notably, the project is being developed as the only all-in-one urban complex in the core Northeast of HCMC. La Pura features over 100 integrated amenities spanning from the ground level to rooftop, highlighted by a shopping mall, Japanese-standard medical clinic, and international-standard schools. These facilities cater to the stringent needs of nearly 45,000 foreign experts and engineers, creating a sustainable rental market and optimizing investment efficiency.

In summary, when competitive pricing aligns with the TOD wave and is reinforced by strong rental demand, the combined effect creates a compelling investment proposition that international investors cannot afford to overlook.