Phat Dat settles bonds before maturity

Phat Dat Real Estate Development Corporation (HOSE: PDR) has just announced the finalization of the Ninth bond issue in 2021 (PDRH2123009) with a total par value of VND 150 billion.

No repayment pressure from bonds

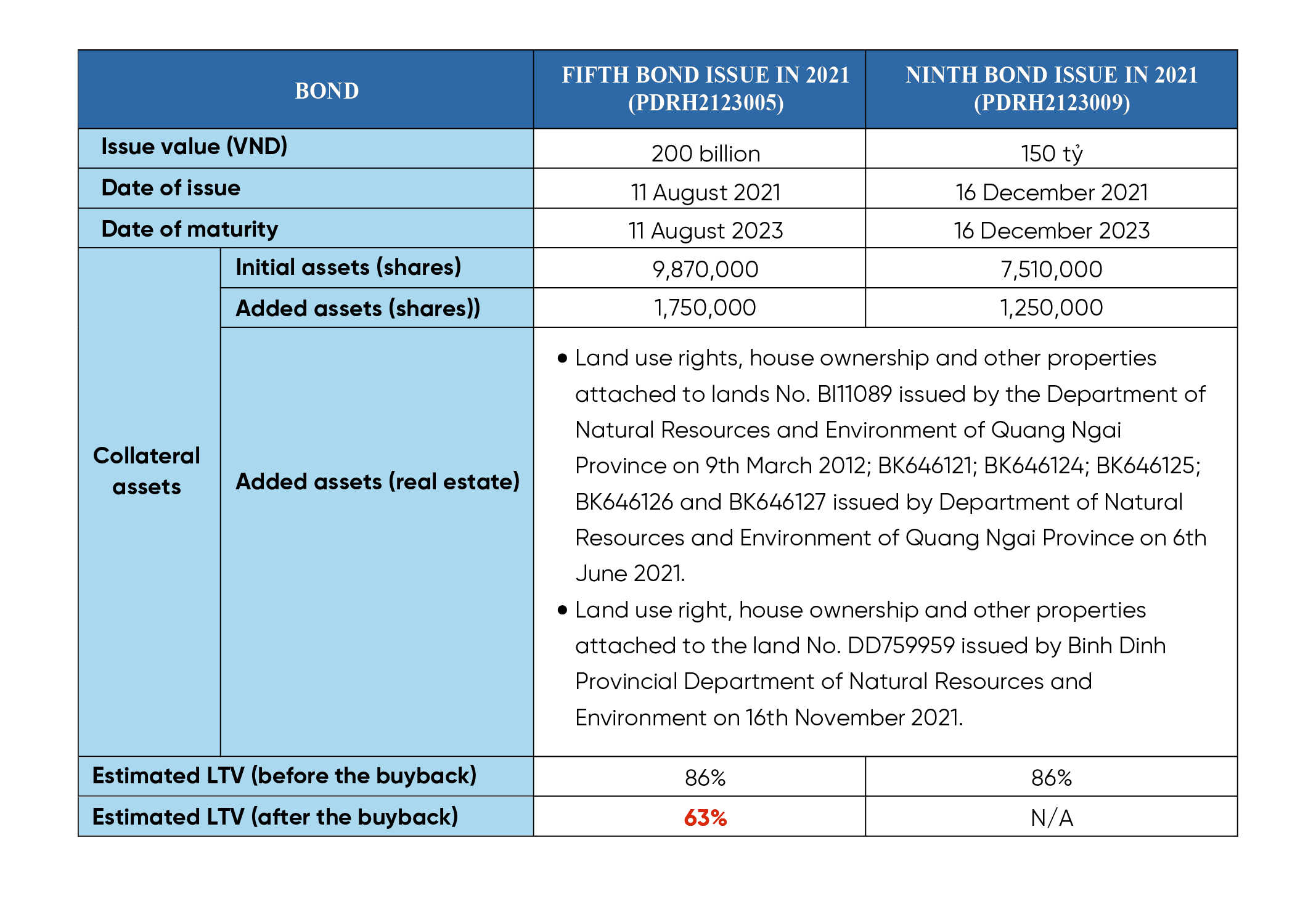

The bonds were issued on 16th December 2021 with a 2-year term, but the early buyback was made on 25th November 2022 as agreed between Phat Dat and bondholders. According to the Company representative, capital flows have been planned to pay off maturing debts, including bonds, from the end of this year to the end of 2023.

Recently, on the 21st and 25th of October 2022, Phat Dat settled capital loans worth VND 220 billion for Mirae Asset Financial Group (Korea). Thus, Phat Dat’s outstanding loans decreased by VND 370 billion compared to the data recorded in 3Q2022’s financial statements.

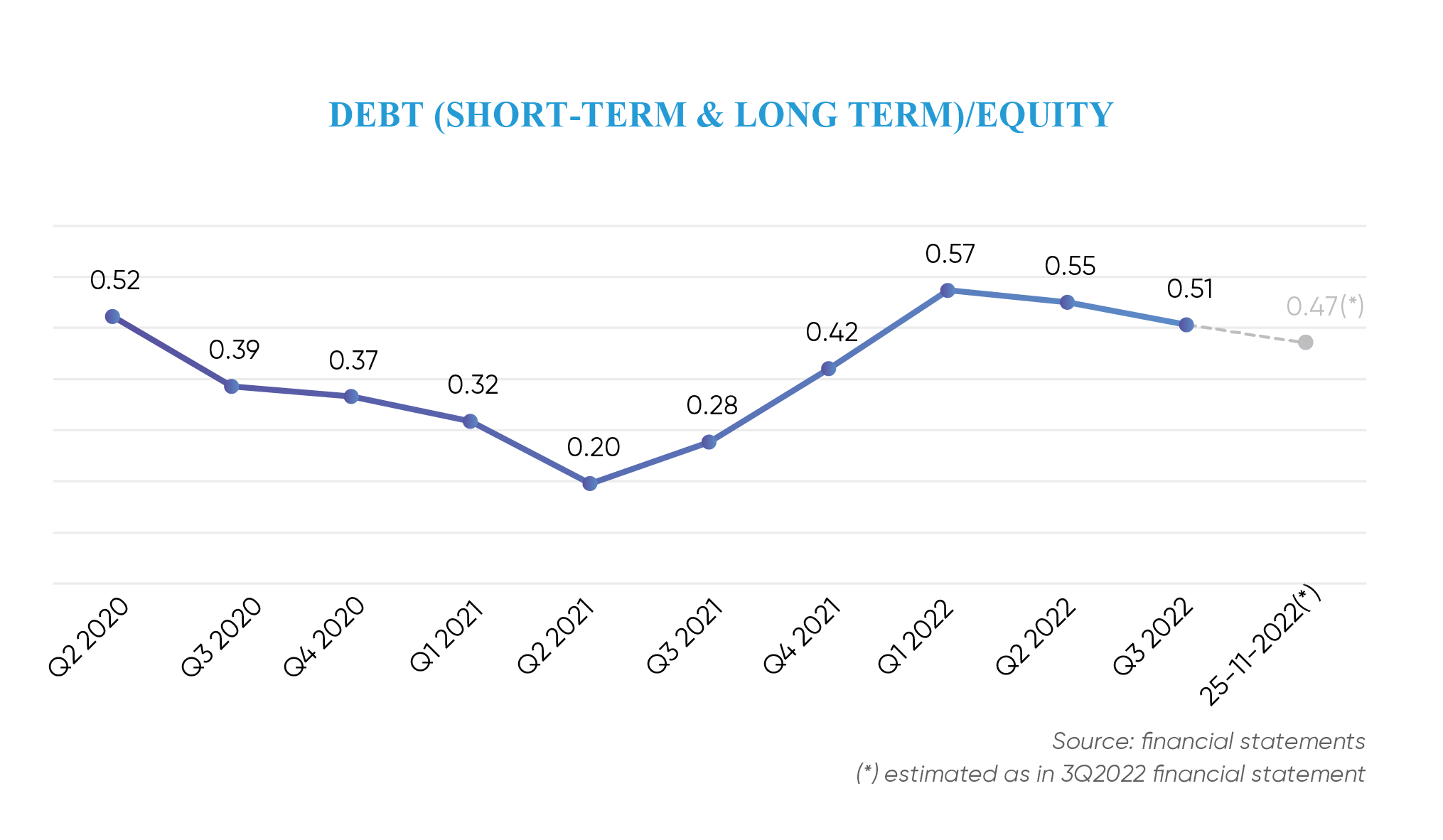

After finalizing the Ninth bond issue, the total loans (short-term and long-term) dropped to VND 4,896 billion, in which the outstanding bond decreased to VND 2,698 billion. Thus, the “Debt (short-term & long-term)/Equity” ratio is calculated at 0.47, compared to 0.51 at the end of 3Q2022. Since 2Q2020, Phat Dat has consistently kept this ratio positive (below 0.5).

Increase bond collateral

Phat Dat’s bond issues are secured by PDR shares. Recently, PDR’s stock has dropped due to investors’ concerns about the less positive macroeconomic outlook and policies related to the real estate market. Also, shareholders unable to meet margin calls are subject to forced sell by securities companies to maintain sufficient equity.

Phat Dat soon added assets to serve as collateral for bond issuances. In truth, Phat Dat’s bond value is minimal in comparison to its entire assets or to other market real estate developers.

In detail, Phat Dat supplemented additional PDR shares and real estate as collateral for the Ninth bond issue-2021 (redeemed before the maturity on 25th November 2022) and the Fifth bond issue-20213. The property mentioned is land use rights in Quang Ngai, with an estimated value of about VND 200 billion.

After the Fifth bond issue was redeemed, the total collateral assets available for the Fifth bond issuance in 2021 is estimated at VND 316.2 billion, and the new LTV ratio (loan balance/collateral value) is 63%, with a par value of VND 10,000/share used for calculating PDR shares. Generally, all bonds issued by Phat Dat have a fairly good LTV ratio, ensuring obligations for bondholders.

Sharing with the press recently, Mr. Bui Quang Anh Vu, a Board Member and CEO of Phat Dat, affirmed that the Company always pays bond interest and principal on time, and the same for loans. This affirmation is supported by sound financial health and the well-prepared resources to develop projects in 2023. Phat Dat is also flexible in changing its business tactics to adapt to the changing market.